Make an

impact today

When you choose to give, you become part of something bigger—something powerful.

Why give?

-

✽

Make A Difference

Your donation helps create real, measurable change in the lives of those we serve.

-

✽

Support A Cause You Love

Give back to something that aligns with your values and passions.

-

✽

Be Part of A Solution

Join a community of people working together to address important issues.

-

✽

Create Lasting Impact

Your contribution helps build long-term solutions, not just quick fixes.

-

✽

Fund Grassroots Work

Support local, hands-on efforts that make a difference where it matters most.

-

✽

Inspire Others

Your generosity can motivate friends, family, and colleagues to do the same.

What People Are Saying

“Every detail was thoughtfully executed. We're thrilled with the outcome.”

— Former Customer“Communication was top-notch and the final outcome was even better than we imagined. A great experience all around.”

— Former CustomerMake a Donation

When you choose to give, you become part of something bigger—something powerful. Your support fuels progress and brings hope where it's needed most.

Frequently Asked Questions

-

Yes, donations to qualified charities are often tax-deductible in the U.S. if you itemize deductions, allowing you to reduce your taxable income, but you need records, and limits (like up to 60% of Adjusted Gross Income for cash) apply, with special rules for non-cash gifts and for those who take the standard deduction in 2026

. You must donate to an IRS-approved 501(c)(3) organization and keep good documentation.

For the 2026 Tax Year (File in 2027): A new rule allows non-itemizers to deduct up to $1,000 (single) or $2,000 (married filing jointly) as an "above-the-line" deduction, while itemizers still follow existing rules.

-

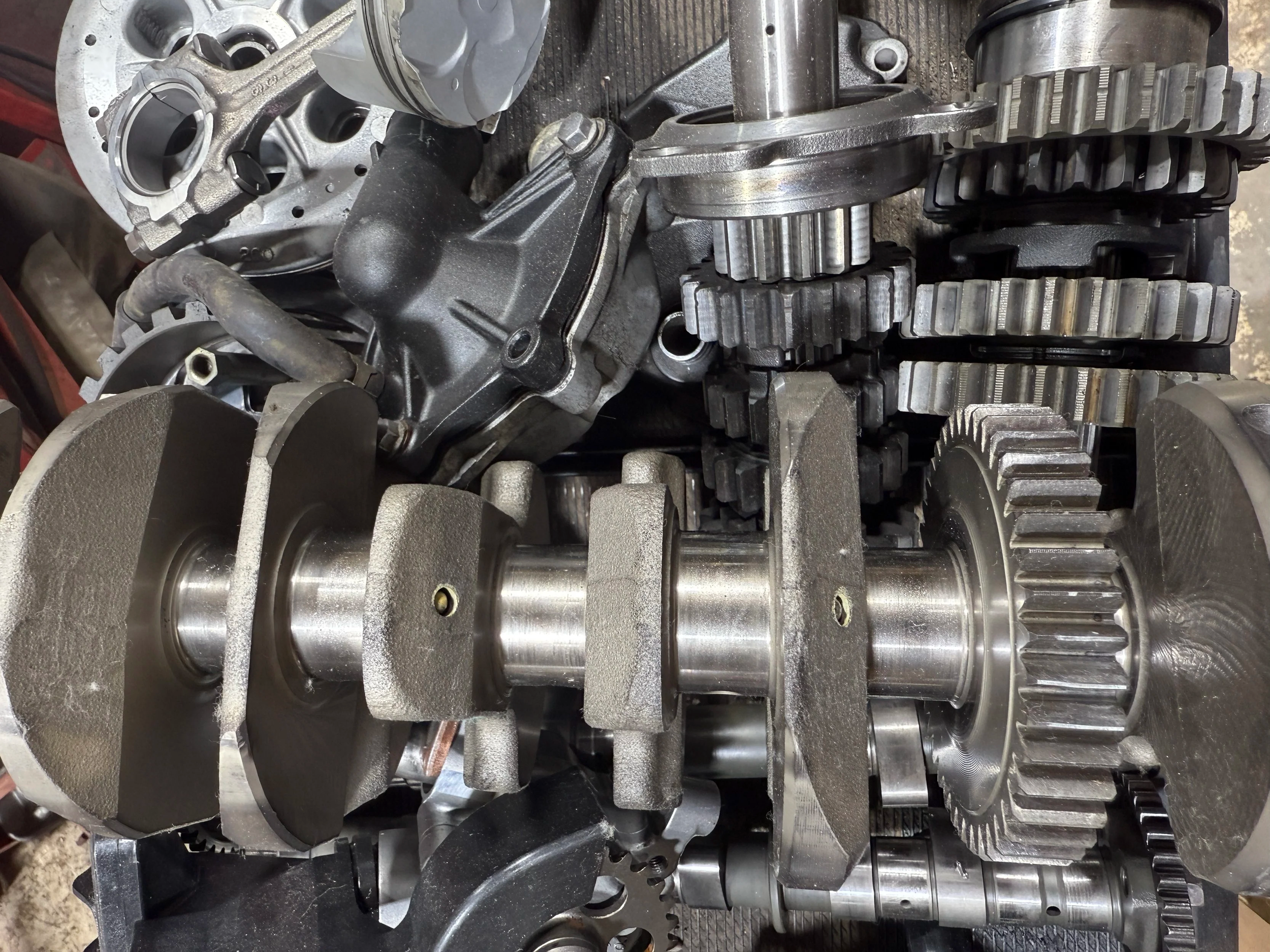

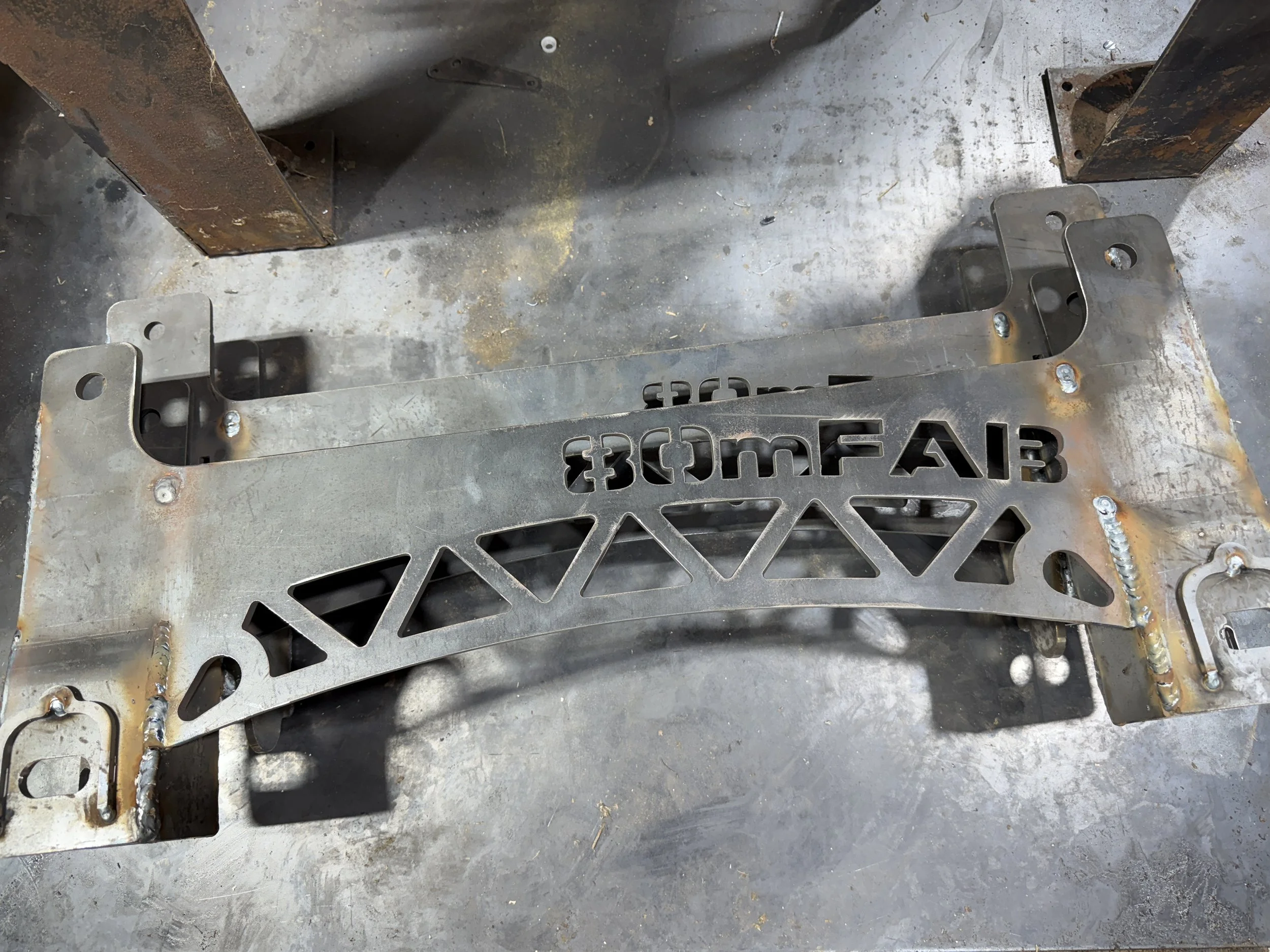

Help 80MFAB cover expenses like material we don’t bill for.

-

You can tell a friend about us. We always want to use popular artwork and innovations.

-

Yes, many organizations accept in-kind donations

(non-monetary gifts like goods or services) but typically have specific policies, often requiring items/services that align with their mission, and need proper documentation for tax purposes, so you should always check their donation guidelines first. In-kind gifts provide significant support by reducing costs for things like event venues, supplies, or specialized skills, but organizations must manage them with clear acceptance policies, donor agreements, and acknowledgment receipts for accounting and tax compliance.

-

We are happy to put names or logo work on our items.